Chapter 11 Linear model 2

11.1 Learning goals

- Multiple regression.

- Appreciate model assumptions.

- Several continuous predictors.

- Hypothesis tests.

- Interpreting parameters.

- Reporting results.

- One categorical predictor.

- Both continuous and categorical predictors.

- Interpreting interactions.

11.2 Load packages and set plotting theme

library("knitr") # for knitting RMarkdown

library("kableExtra") # for making nice tables

library("janitor") # for cleaning column names

library("broom") # for tidying up linear models

library("corrr") # for calculating correlations between many variables

library("corrplot") # for plotting correlations

library("GGally") # for running ggpairs() function

library("tidyverse") # for wrangling, plotting, etc.

# include references for used packages

knitr::write_bib(.packages(), "packages.bib") 11.3 Load data sets

Let’s load the data sets that we’ll explore in this class:

# credit data set

df.credit = read_csv("data/credit.csv") %>%

rename(index = `...1`) %>%

clean_names()

# advertising data set

df.ads = read_csv("data/advertising.csv") %>%

rename(index = `...1`) %>%

clean_names()| variable | description |

|---|---|

| income | in thousand dollars |

| limit | credit limit |

| rating | credit rating |

| cards | number of credit cards |

| age | in years |

| education | years of education |

| gender | male or female |

| student | student or not |

| married | married or not |

| ethnicity | African American, Asian, Caucasian |

| balance | average credit card debt |

11.4 Multiple continuous variables

Let’s take a look at a case where we have multiple continuous predictor variables. In this case, we want to make sure that our predictors are not too highly correlated with each other (as this makes the interpration of how much each variable explains the outcome difficult). So we first need to explore the pairwise correlations between variables.

11.4.1 Explore correlations

The corrr package is great for exploring correlations between variables. To find out more how corrr works, take a look at this vignette:

Here is an example that illustrates some of the key functions in the corrr package (using the advertisement data):

term index tv radio newspaper sales

1 index

2 tv .02

3 radio -.11 .05

4 newspaper -.15 .06 .35

5 sales -.05 .78 .58 .23 11.4.1.1 Visualize correlations

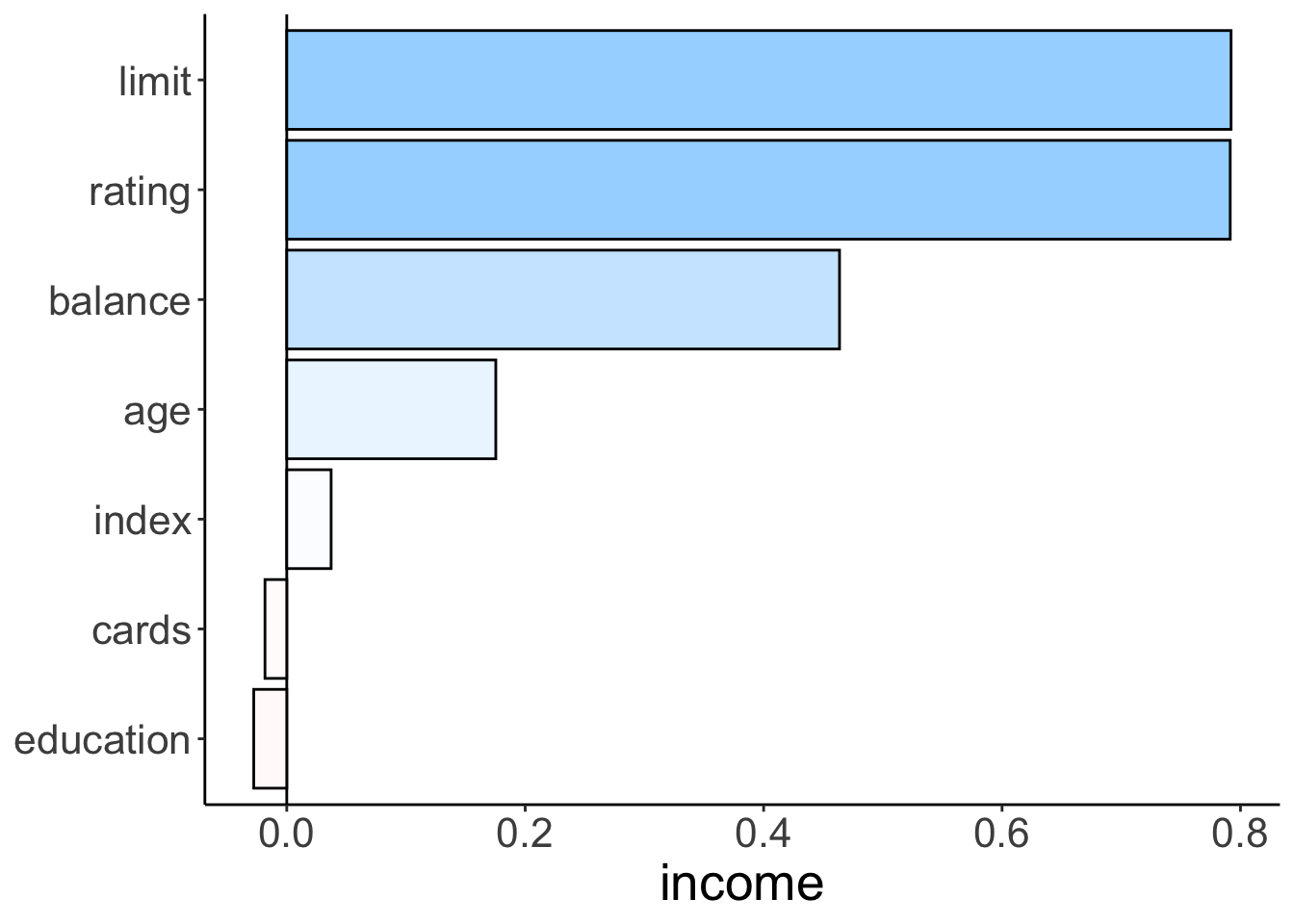

11.4.1.1.1 Correlations with the dependent variable

df.credit %>%

select(where(is.numeric)) %>%

correlate(quiet = T) %>%

select(term, income) %>%

mutate(term = reorder(term, income)) %>%

drop_na() %>%

ggplot(aes(x = term,

y = income,

fill = income)) +

geom_hline(yintercept = 0) +

geom_col(color = "black",

show.legend = F) +

scale_fill_gradient2(low = "indianred2",

mid = "white",

high = "skyblue1",

limits = c(-1, 1)) +

coord_flip() +

theme(axis.title.y = element_blank())

Figure 2.7: Bar plot illustrating how strongly different variables correlate with income.

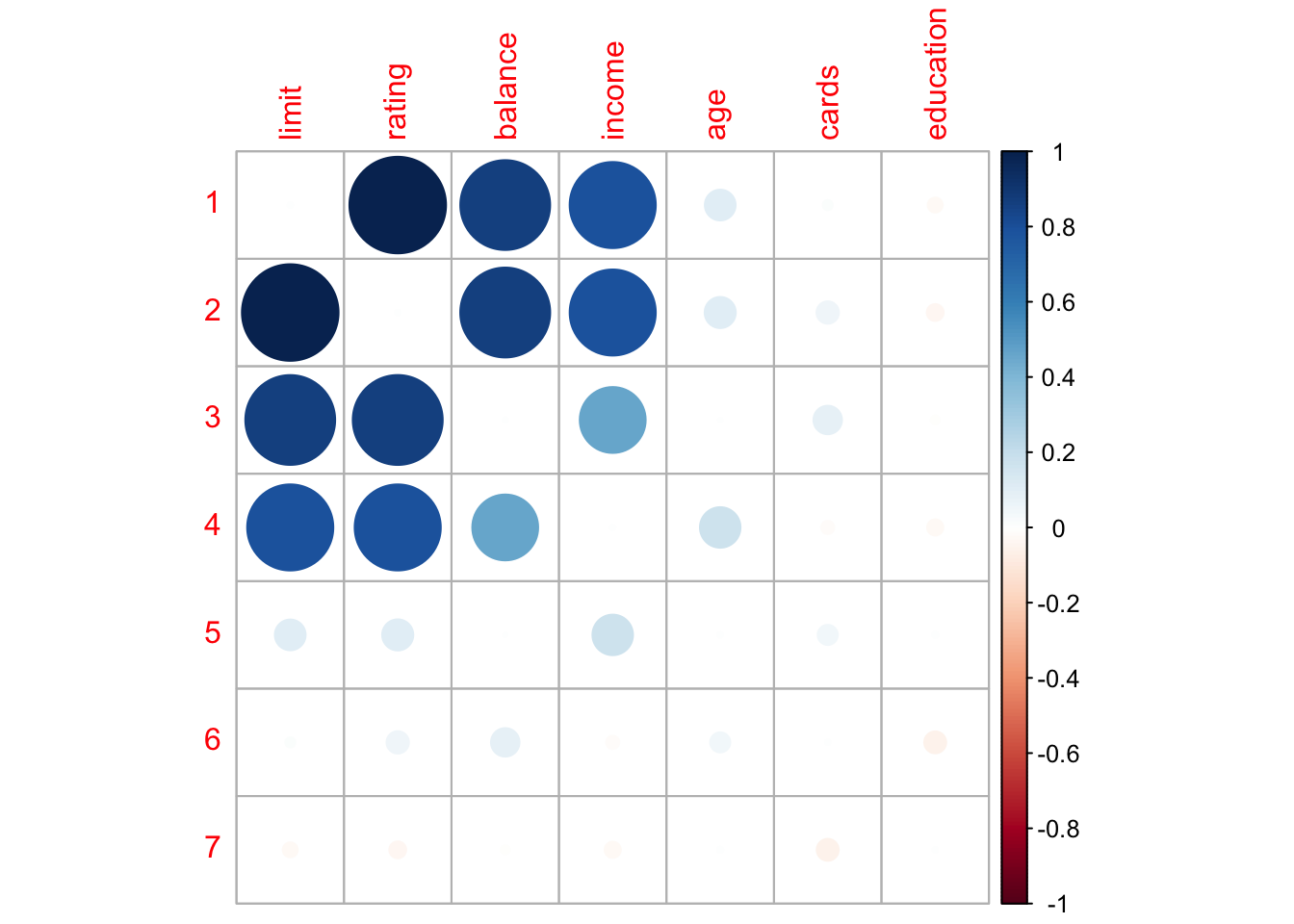

11.4.1.1.2 All pairwise correlations

tmp = df.credit %>%

select(where(is.numeric), -index) %>%

correlate(diagonal = 0,

quiet = T) %>%

rearrange() %>%

select(-term) %>%

as.matrix() %>%

corrplot()

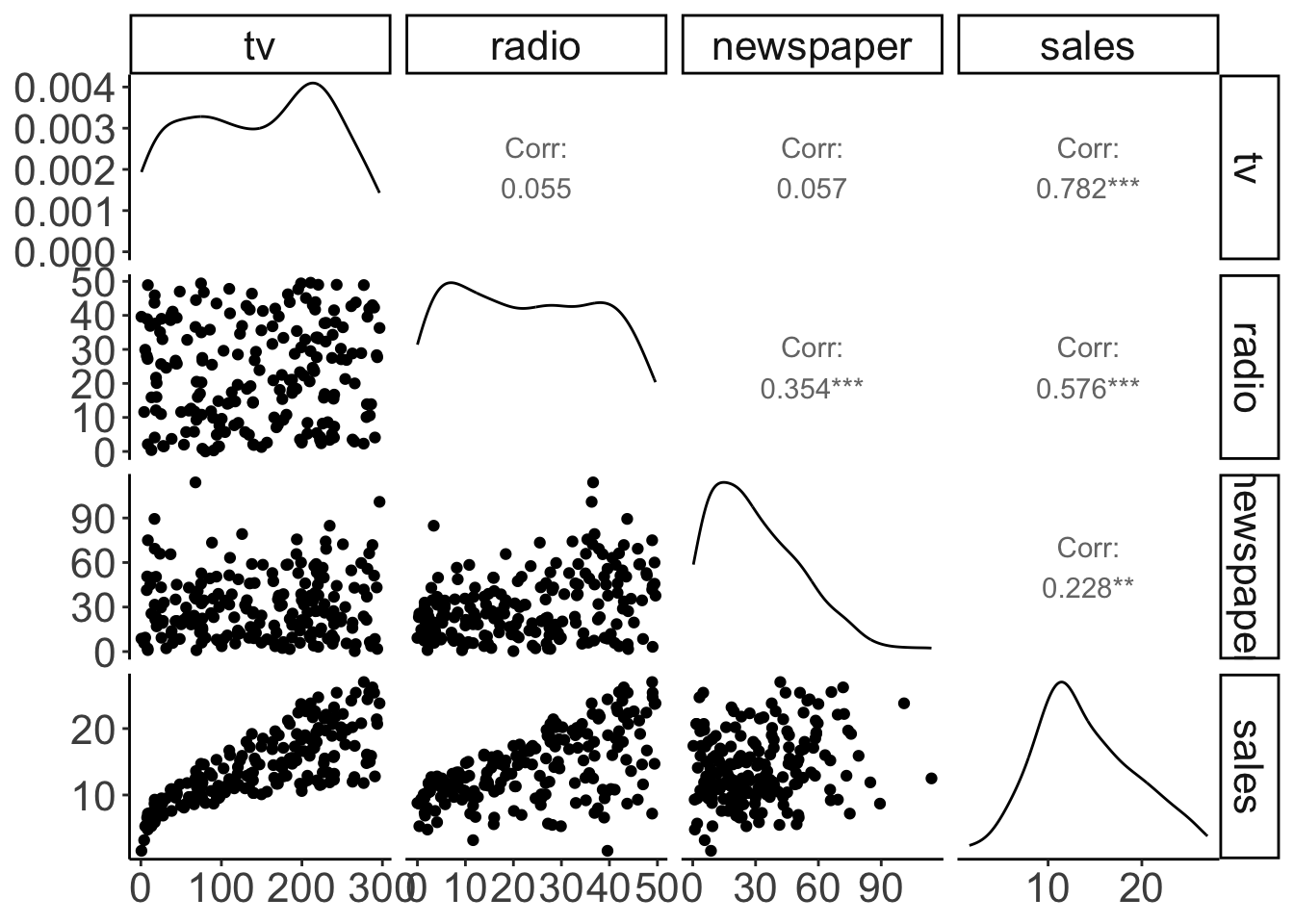

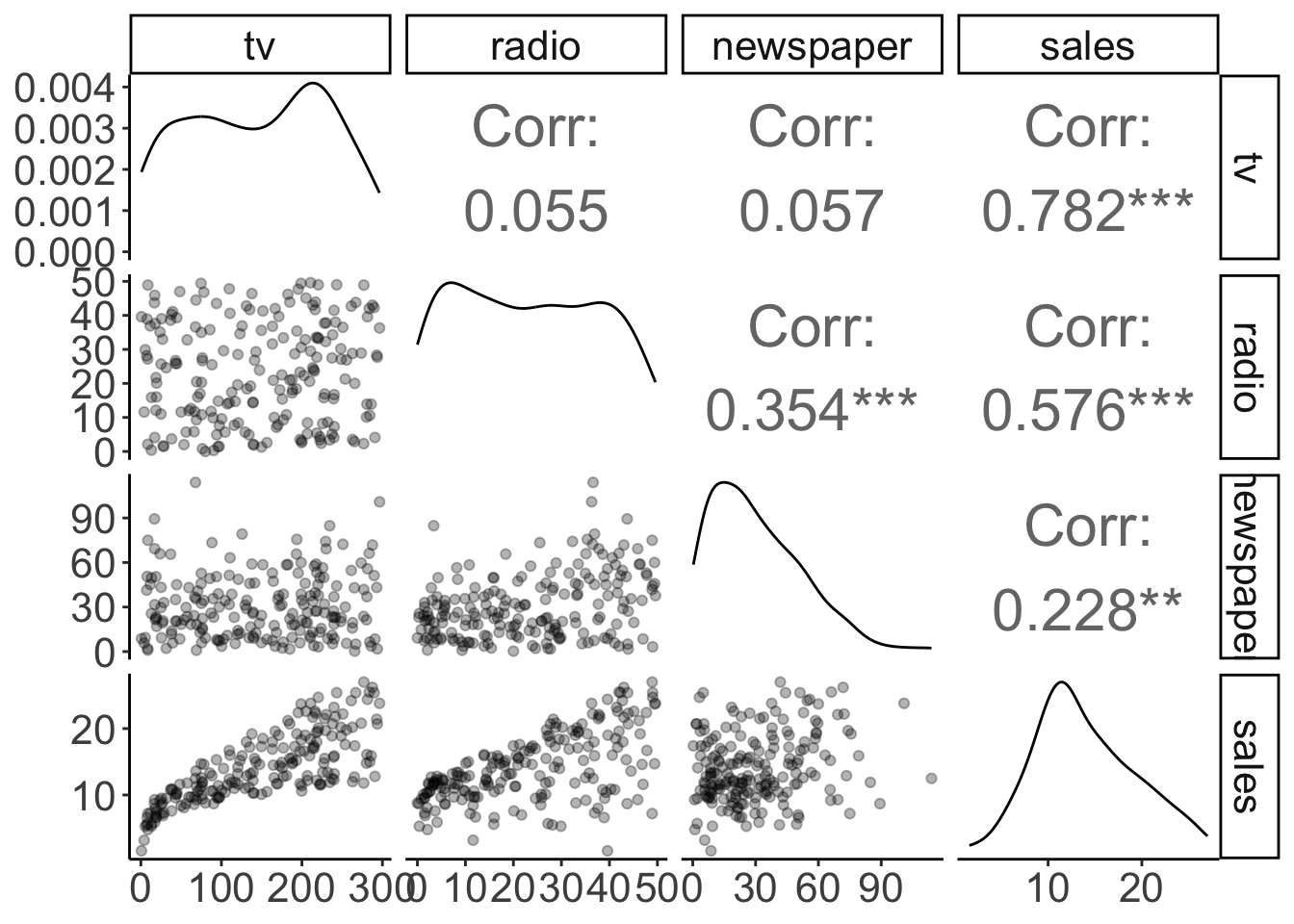

Figure 11.1: Pairwise correlations with scatter plots, correlation values, and densities on the diagonal.

With some customization:

df.ads %>%

select(-index) %>%

ggpairs(lower = list(continuous = wrap("points",

alpha = 0.3)),

upper = list(continuous = wrap("cor", size = 8))) +

theme(panel.grid.major = element_blank())

Figure 11.2: Pairwise correlations with scatter plots, correlation values, and densities on the diagonal (customized).

11.4.2 Multipe regression

Now that we’ve explored the correlations, let’s have a go at the multiple regression.

11.4.2.1 Visualization

We’ll first take another look at the pairwise relationships:

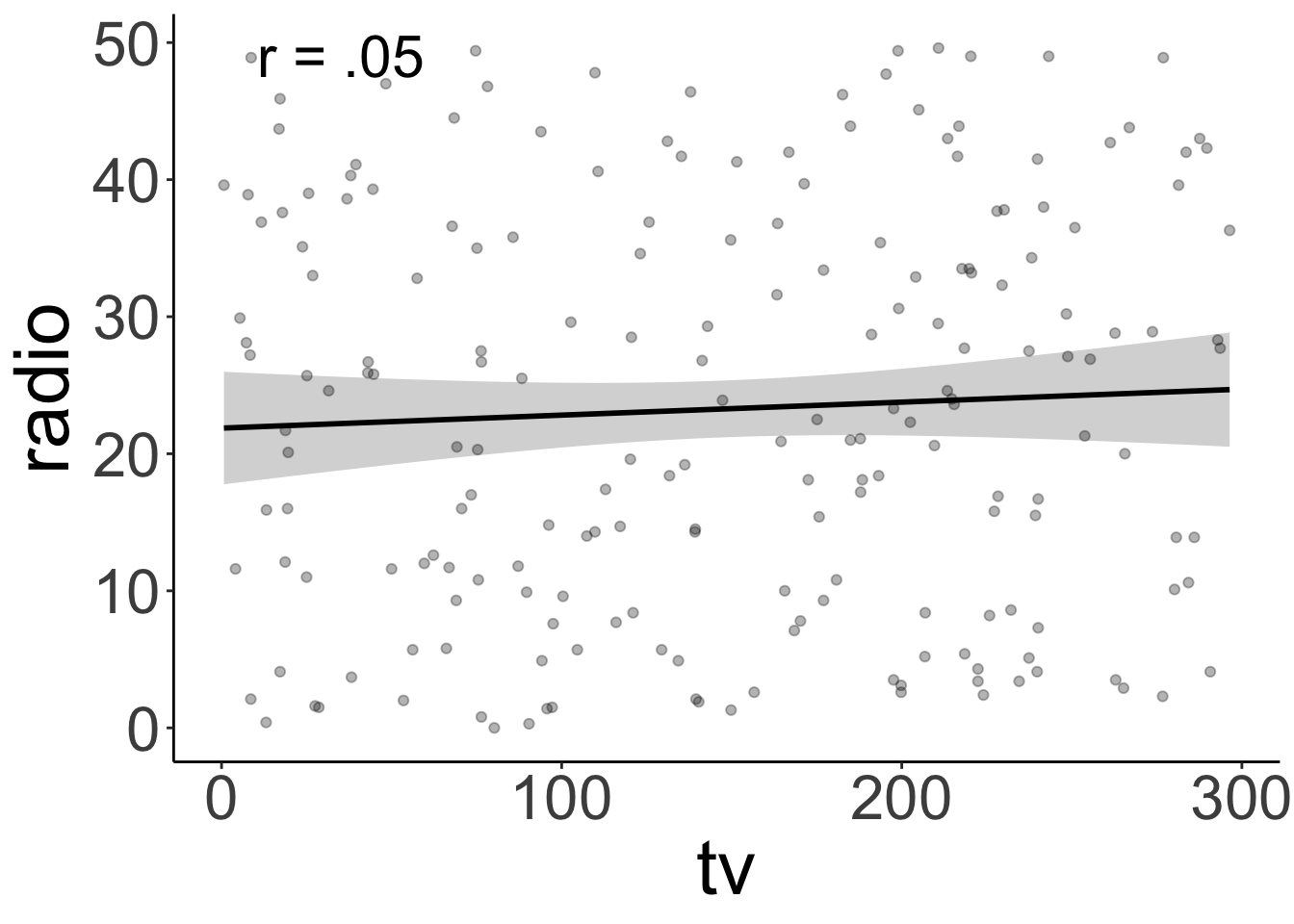

tmp.x = "tv"

# tmp.x = "radio"

# tmp.x = "newspaper"

# tmp.y = "radio"

tmp.y = "radio"

# tmp.y = "tv"

ggplot(df.ads,

aes_string(x = tmp.x, y = tmp.y)) +

stat_smooth(method = "lm",

color = "black",

fullrange = T) +

geom_point(alpha = 0.3) +

annotate(geom = "text",

x = -Inf,

y = Inf,

hjust = -0.5,

vjust = 1.5,

label = str_c("r = ", cor(df.ads[[tmp.x]], df.ads[[tmp.y]]) %>%

round(2) %>% # round

str_remove("^0+") # remove 0

),

size = 8) +

theme(text = element_text(size = 30))Warning: `aes_string()` was deprecated in ggplot2 3.0.0.

ℹ Please use tidy evaluation idioms with `aes()`.

ℹ See also `vignette("ggplot2-in-packages")` for more information.

This warning is displayed once every 8 hours.

Call `lifecycle::last_lifecycle_warnings()` to see where this warning was generated.`geom_smooth()` using formula = 'y ~ x'

TV ads and radio ads aren’t correlated. Yay!

11.4.2.2 Fitting, hypothesis testing, evaluation

Let’s see whether adding radio ads is worth it (over and above having TV ads).

# fit the models

fit_c = lm(sales ~ 1 + tv, data = df.ads)

fit_a = lm(sales ~ 1 + tv + radio, data = df.ads)

# do the F test

anova(fit_c, fit_a)Analysis of Variance Table

Model 1: sales ~ 1 + tv

Model 2: sales ~ 1 + tv + radio

Res.Df RSS Df Sum of Sq F Pr(>F)

1 198 2102.53

2 197 556.91 1 1545.6 546.74 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1It’s worth it!

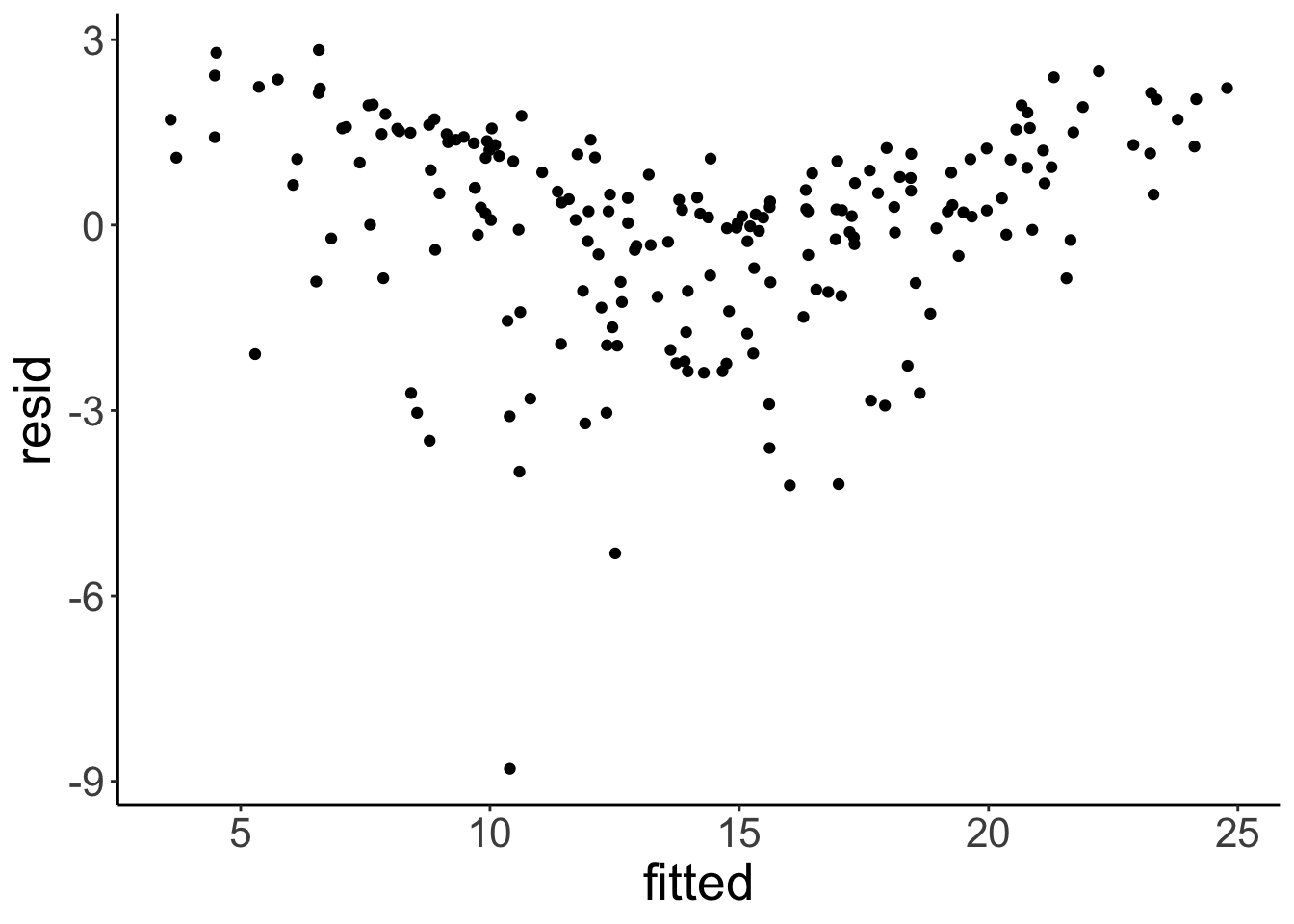

Let’s evaluate how well the model actually does. We do this by taking a look at the residual plot, and check whether the residuals are normally distributed.

tmp.fit = lm(sales ~ 1 + tv + radio, data = df.ads)

df.plot = tmp.fit %>%

augment() %>%

clean_names()

# residual plot

ggplot(df.plot,

aes(x = fitted,

y = resid)) +

geom_point()

# density of residuals

ggplot(df.plot,

aes(x = resid)) +

stat_density(geom = "line")

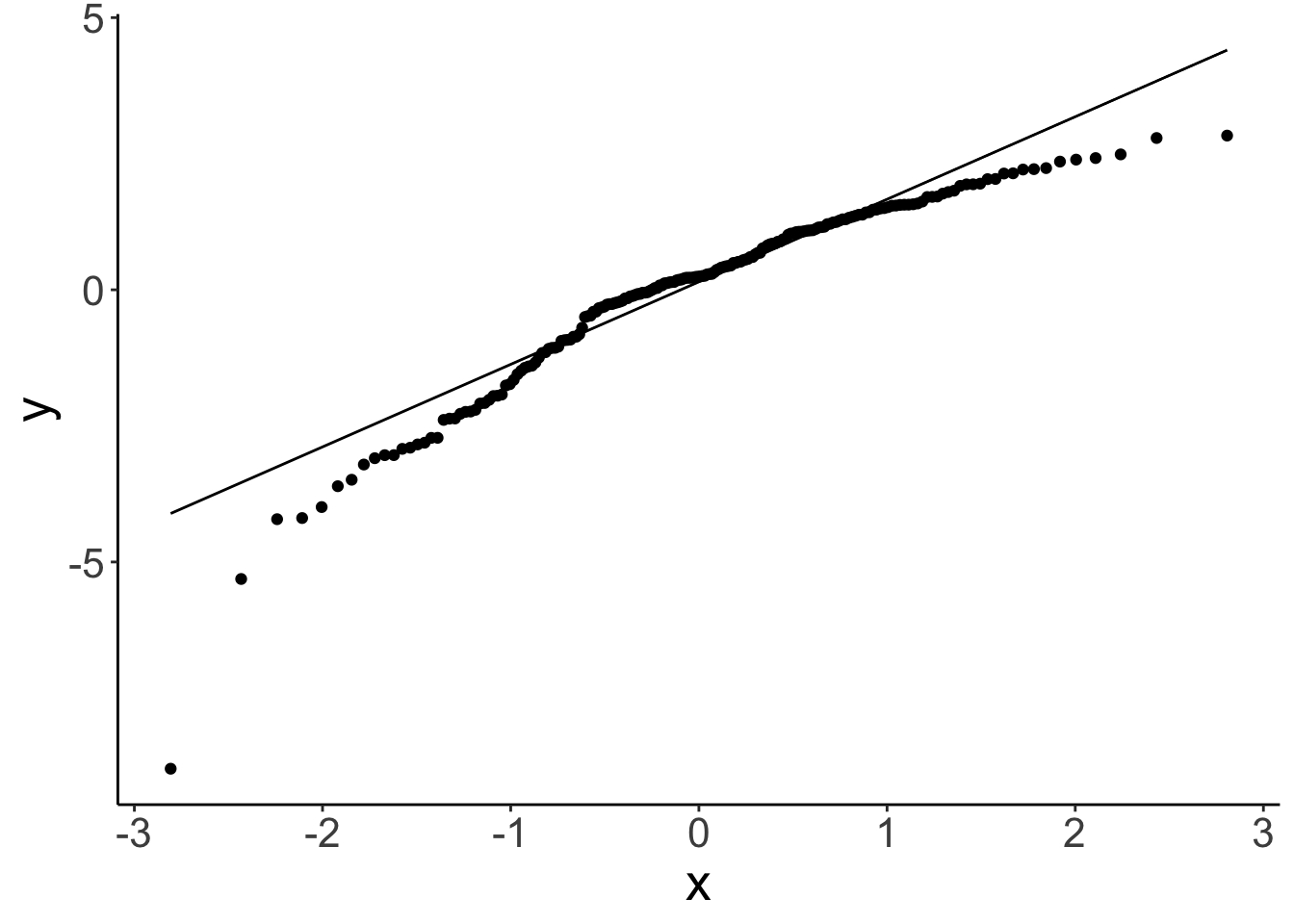

# QQ plot

ggplot(df.plot,

aes(sample = resid)) +

geom_qq() +

geom_qq_line()

There is a slight non-linear trend in the residuals. We can also see that the residuals aren’t perfectly normally distributed. We’ll see later what we can do about this …

Let’s see how well the model does overall:

fit_a %>%

glance() %>%

kable(digits = 3) %>%

kable_styling(bootstrap_options = "striped",

full_width = F)| r.squared | adj.r.squared | sigma | statistic | p.value | df | logLik | AIC | BIC | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.897 | 0.896 | 1.681 | 859.618 | 0 | 2 | -386.197 | 780.394 | 793.587 | 556.914 | 197 | 200 |

As we can see, the model almost explains 90% of the variance. That’s very decent!

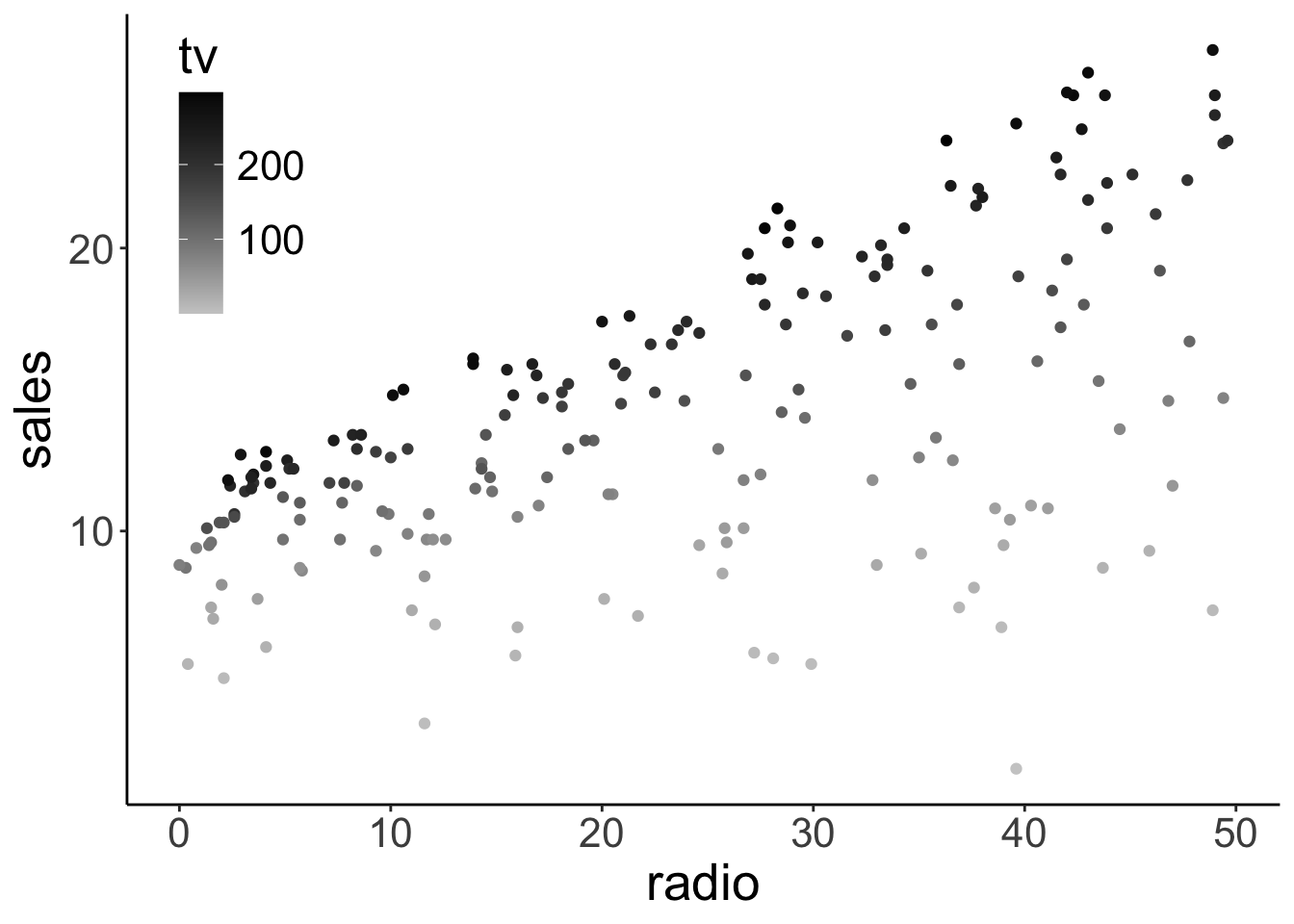

11.4.2.3 Visualizing the model fits

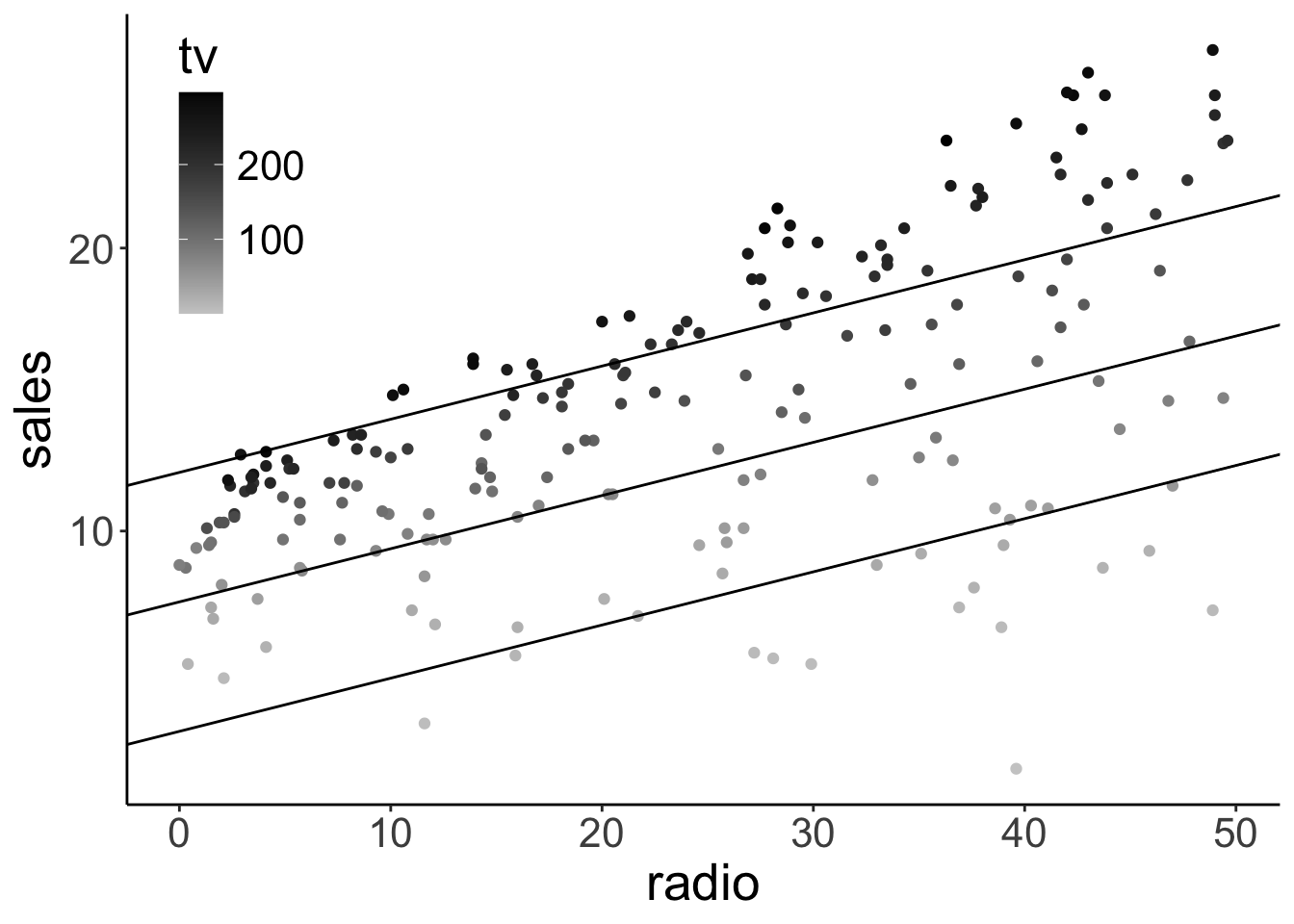

Here is a way of visualizing how both tv ads and radio ads affect sales:

df.plot = lm(sales ~ 1 + tv + radio, data = df.ads) %>%

augment() %>%

clean_names()

df.tidy = lm(sales ~ 1 + tv + radio, data = df.ads) %>%

tidy()

ggplot(df.plot, aes(x = radio, y = sales, color = tv)) +

geom_point() +

scale_color_gradient(low = "gray80", high = "black") +

theme(legend.position = c(0.1, 0.8))Warning: A numeric `legend.position` argument in `theme()` was deprecated in ggplot2 3.5.0.

ℹ Please use the `legend.position.inside` argument of `theme()` instead.

This warning is displayed once every 8 hours.

Call `lifecycle::last_lifecycle_warnings()` to see where this warning was generated.

We used color here to encode TV ads (and the x-axis for the radio ads).

In addition, we might want to illustrate what relationship between radio ads and sales the model predicts for three distinct values for TV ads. Like so:

df.plot = lm(sales ~ 1 + tv + radio, data = df.ads) %>%

augment() %>%

clean_names()

df.tidy = lm(sales ~ 1 + tv + radio, data = df.ads) %>%

tidy()

ggplot(df.plot, aes(x = radio, y = sales, color = tv)) +

geom_point() +

geom_abline(intercept = df.tidy$estimate[1] + df.tidy$estimate[2] * 200,

slope = df.tidy$estimate[3]) +

geom_abline(intercept = df.tidy$estimate[1] + df.tidy$estimate[2] * 100,

slope = df.tidy$estimate[3]) +

geom_abline(intercept = df.tidy$estimate[1] + df.tidy$estimate[2] * 0,

slope = df.tidy$estimate[3]) +

scale_color_gradient(low = "gray80", high = "black") +

theme(legend.position = c(0.1, 0.8))

11.4.2.4 Interpreting the model fits

Fitting the augmented model yields the following estimates for the coefficients in the model:

fit_a %>%

tidy(conf.int = T) %>%

head(10) %>%

kable(digits = 2) %>%

kable_styling(bootstrap_options = "striped",

full_width = F)| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 2.92 | 0.29 | 9.92 | 0 | 2.34 | 3.50 |

| tv | 0.05 | 0.00 | 32.91 | 0 | 0.04 | 0.05 |

| radio | 0.19 | 0.01 | 23.38 | 0 | 0.17 | 0.20 |

11.4.2.5 Standardizing the predictors

One thing we can do to make different predictors more comparable is to standardize them.

df.ads = df.ads %>%

mutate(across(.cols = c(tv, radio),

.fns = ~ scale(.),

.names = "{.col}_scaled"))

df.ads %>%

select(-newspaper) %>%

head(10) %>%

kable(digits = 2) %>%

kable_styling(bootstrap_options = "striped",

full_width = F)| index | tv | radio | sales | tv_scaled | radio_scaled |

|---|---|---|---|---|---|

| 1 | 230.1 | 37.8 | 22.1 | 0.96742460 | 0.9790656 |

| 2 | 44.5 | 39.3 | 10.4 | -1.19437904 | 1.0800974 |

| 3 | 17.2 | 45.9 | 9.3 | -1.51235985 | 1.5246374 |

| 4 | 151.5 | 41.3 | 18.5 | 0.05191939 | 1.2148065 |

| 5 | 180.8 | 10.8 | 12.9 | 0.39319551 | -0.8395070 |

| 6 | 8.7 | 48.9 | 7.2 | -1.61136487 | 1.7267010 |

| 7 | 57.5 | 32.8 | 11.8 | -1.04295960 | 0.6422929 |

| 8 | 120.2 | 19.6 | 13.2 | -0.31265202 | -0.2467870 |

| 9 | 8.6 | 2.1 | 4.8 | -1.61252963 | -1.4254915 |

| 10 | 199.8 | 2.6 | 10.6 | 0.61450084 | -1.3918142 |

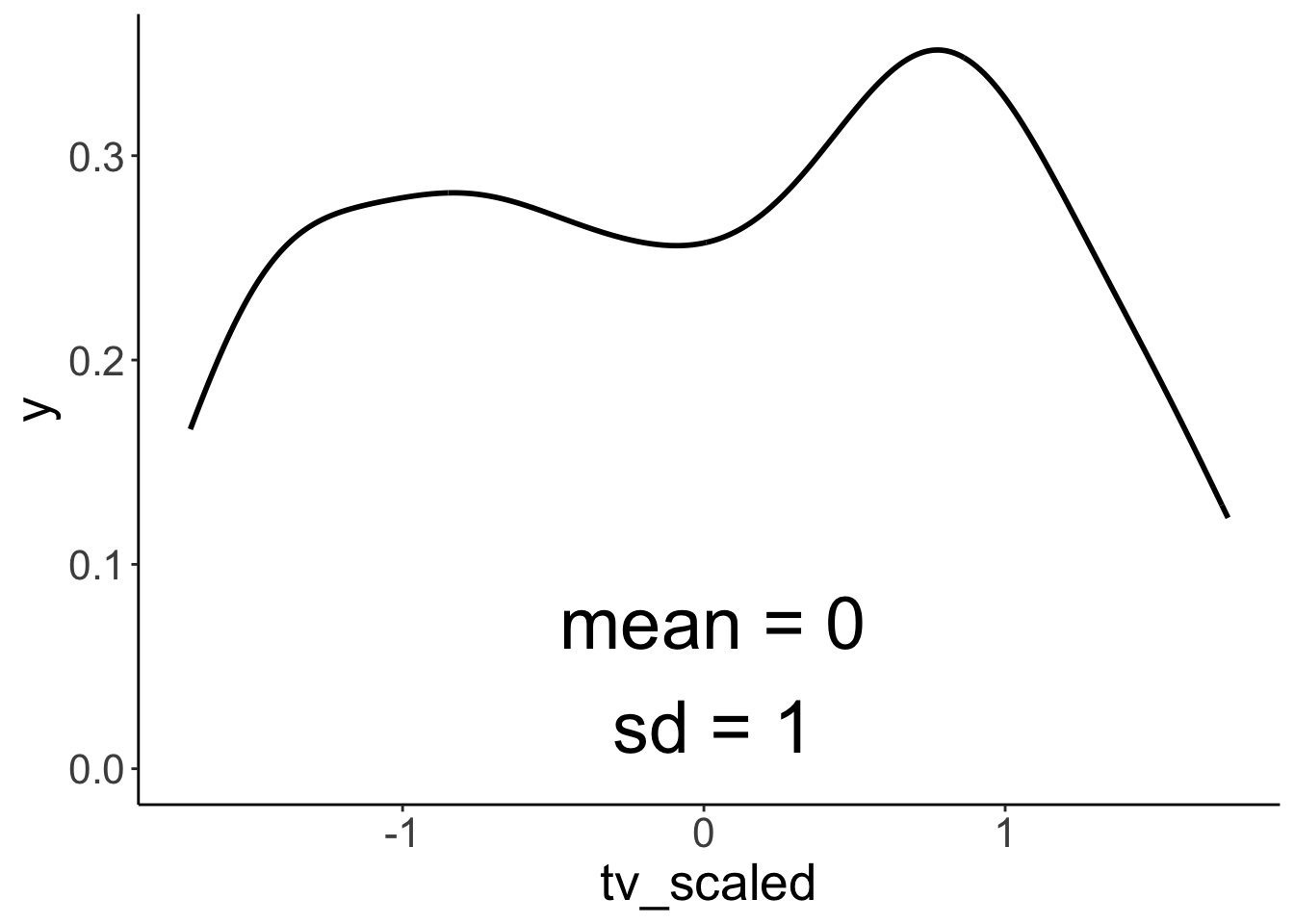

We can standardize (z-score) variables using the scale() function.

# tmp.variable = "tv"

tmp.variable = "tv_scaled"

ggplot(df.ads,

aes(x = .data[[tmp.variable]])) +

stat_density(geom = "line",

size = 1) +

annotate(geom = "text",

x = median(df.ads[[tmp.variable]]),

y = -Inf,

label = str_c("sd = ", sd(df.ads[[tmp.variable]]) %>% round(2)),

size = 10,

vjust = -1,

hjust = 0.5) +

annotate(geom = "text",

x = median(df.ads[[tmp.variable]]),

y = -Inf,

label = str_c("mean = ", mean(df.ads[[tmp.variable]]) %>% round(2)),

size = 10,

vjust = -3,

hjust = 0.5)Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

ℹ Please use `linewidth` instead.

This warning is displayed once every 8 hours.

Call `lifecycle::last_lifecycle_warnings()` to see where this warning was generated.

Scaling a variable leaves the distribution intact, but changes the mean to 0 and the SD to 1.

11.5 One categorical variable

Let’s compare a compact model that only predicts the mean, with a model that uses the student variable as an additional predictor.

# fit the models

fit_c = lm(balance ~ 1, data = df.credit)

fit_a = lm(balance ~ 1 + student, data = df.credit)

# run the F test

anova(fit_c, fit_a)Analysis of Variance Table

Model 1: balance ~ 1

Model 2: balance ~ 1 + student

Res.Df RSS Df Sum of Sq F Pr(>F)

1 399 84339912

2 398 78681540 1 5658372 28.622 1.488e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Call:

lm(formula = balance ~ 1 + student, data = df.credit)

Residuals:

Min 1Q Median 3Q Max

-876.82 -458.82 -40.87 341.88 1518.63

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 480.37 23.43 20.50 < 2e-16 ***

studentYes 396.46 74.10 5.35 1.49e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 444.6 on 398 degrees of freedom

Multiple R-squared: 0.06709, Adjusted R-squared: 0.06475

F-statistic: 28.62 on 1 and 398 DF, p-value: 1.488e-07The summary() shows that it’s worth it: the augmented model explains a signifcant amount of the variance (i.e. it significantly reduces the proportion in error PRE).

11.5.1 Visualization of the model predictions

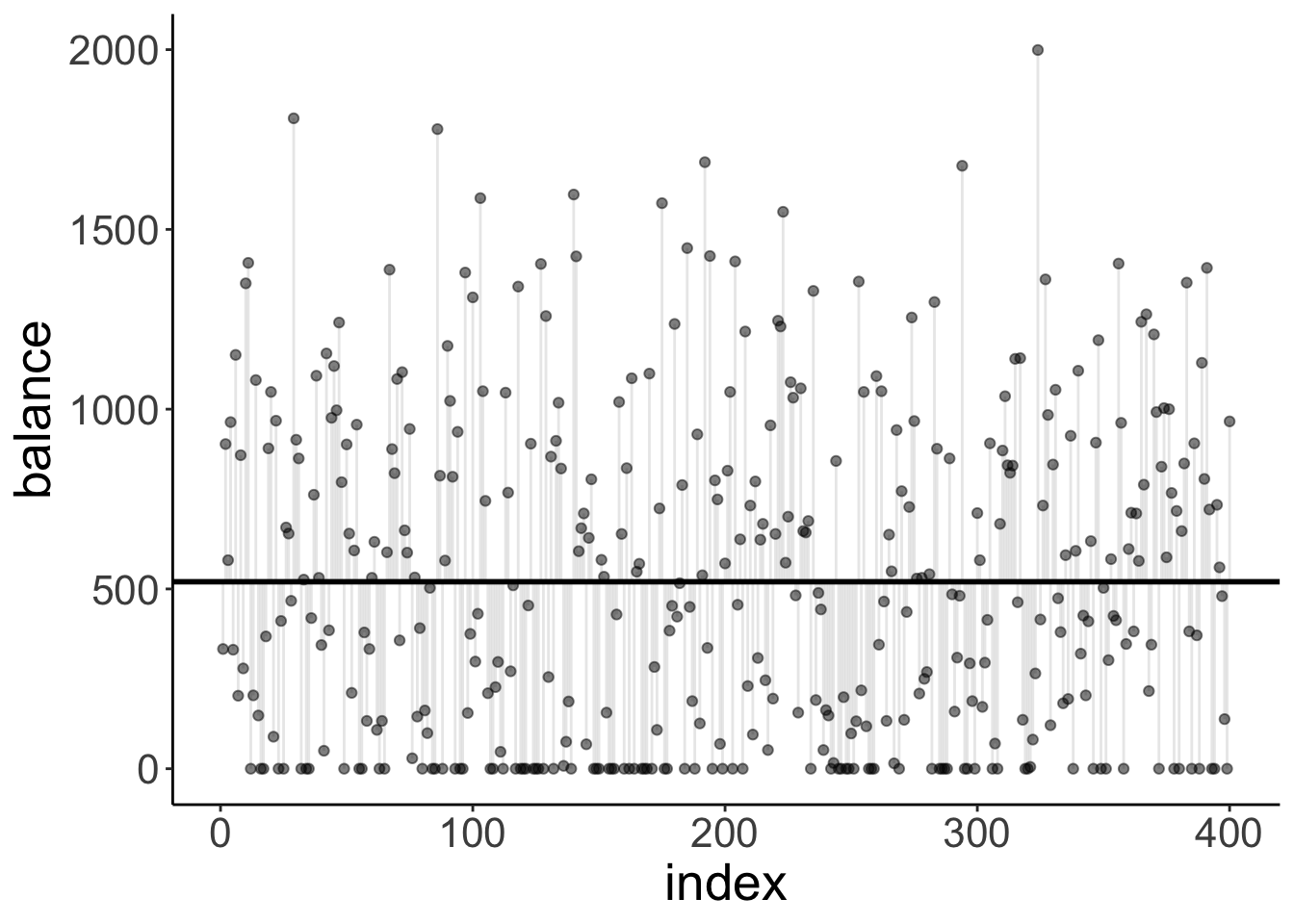

Let’s visualize the model predictions. Here is the compact model:

ggplot(df.credit,

aes(x = index,

y = balance)) +

geom_hline(yintercept = mean(df.credit$balance),

size = 1) +

geom_segment(aes(xend = index,

yend = mean(df.credit$balance)),

alpha = 0.1) +

geom_point(alpha = 0.5)

It just predicts the mean (the horizontal black line). The vertical lines from each data point to the mean illustrate the residuals.

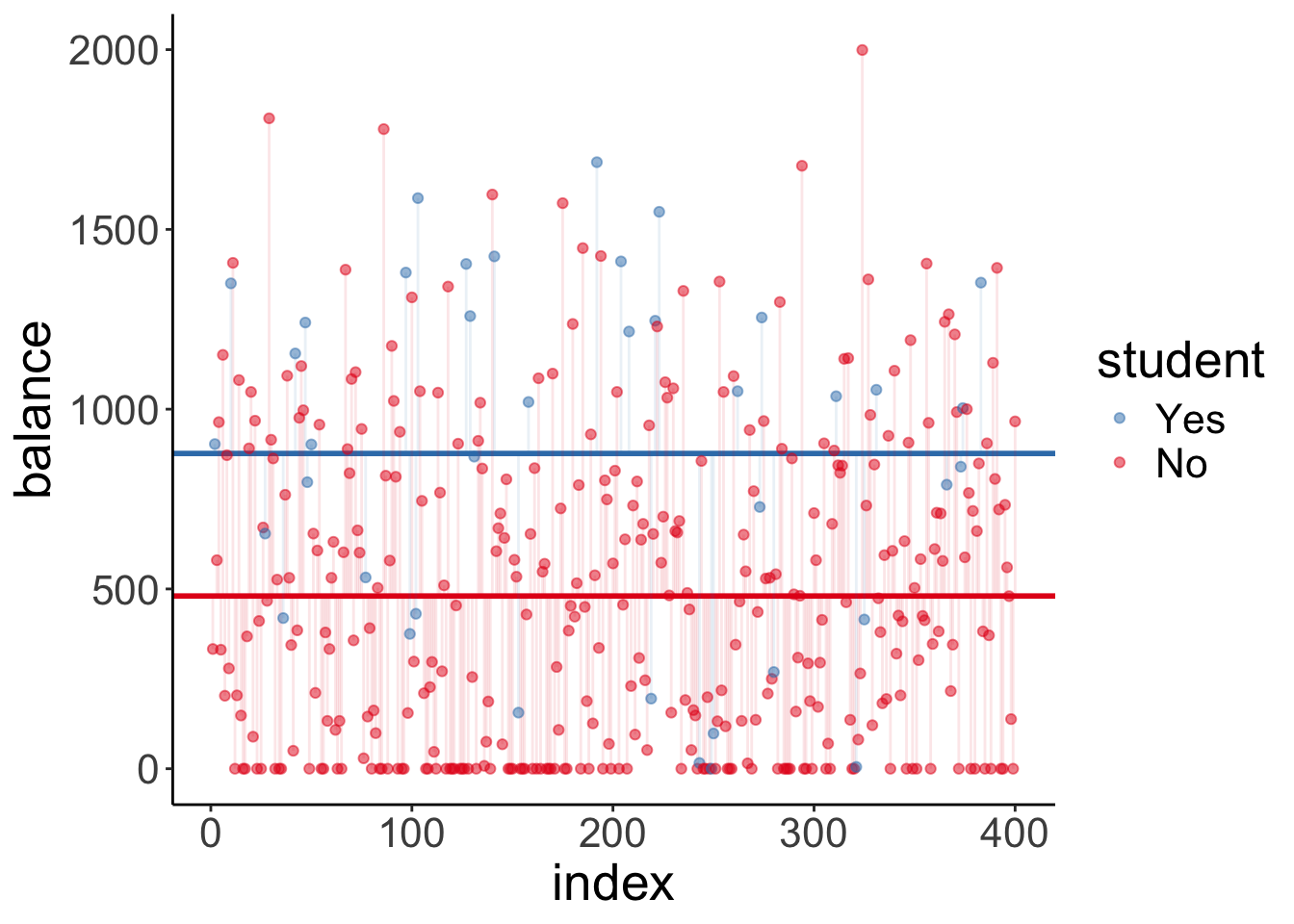

And here is the augmented model:

df.fit = fit_a %>%

tidy() %>%

mutate(estimate = round(estimate,2))

ggplot(df.credit,

aes(x = index,

y = balance,

color = student)) +

geom_hline(yintercept = df.fit$estimate[1],

size = 1,

color = "#E41A1C") +

geom_hline(yintercept = df.fit$estimate[1] + df.fit$estimate[2],

size = 1,

color = "#377EB8") +

geom_segment(data = df.credit %>%

filter(student == "No"),

aes(xend = index,

yend = df.fit$estimate[1]),

alpha = 0.1,

color = "#E41A1C") +

geom_segment(data = df.credit %>%

filter(student == "Yes"),

aes(xend = index,

yend = df.fit$estimate[1] + df.fit$estimate[2]),

alpha = 0.1,

color = "#377EB8") +

geom_point(alpha = 0.5) +

scale_color_brewer(palette = "Set1") +

guides(color = guide_legend(reverse = T))

Note that this model predicts two horizontal lines. One for students, and one for non-students.

Let’s make simple plot that shows the means of both groups with bootstrapped confidence intervals.

ggplot(data = df.credit,

mapping = aes(x = student, y = balance, fill = student)) +

stat_summary(fun = "mean",

geom = "bar",

color = "black",

show.legend = F) +

stat_summary(fun.data = "mean_cl_boot",

geom = "linerange",

size = 1) +

scale_fill_brewer(palette = "Set1")

And let’s double check that we also get a signifcant result when we run a t-test instead of our model comparison procedure:

t.test(x = df.credit$balance[df.credit$student == "No"],

y = df.credit$balance[df.credit$student == "Yes"])

Welch Two Sample t-test

data: df.credit$balance[df.credit$student == "No"] and df.credit$balance[df.credit$student == "Yes"]

t = -4.9028, df = 46.241, p-value = 1.205e-05

alternative hypothesis: true difference in means is not equal to 0

95 percent confidence interval:

-559.2023 -233.7088

sample estimates:

mean of x mean of y

480.3694 876.8250 11.5.2 Dummy coding

When we put a variable in a linear model that is coded as a character or as a factor, R automatically recodes this variable using dummy coding. It uses level 1 as the reference category for factors, or the value that comes first in the alphabet for characters.

df.credit %>%

select(income, student) %>%

mutate(student_dummy = ifelse(student == "No", 0, 1))%>%

head(10) %>%

kable(digits = 2) %>%

kable_styling(bootstrap_options = "striped",

full_width = F)| income | student | student_dummy |

|---|---|---|

| 14.89 | No | 0 |

| 106.03 | Yes | 1 |

| 104.59 | No | 0 |

| 148.92 | No | 0 |

| 55.88 | No | 0 |

| 80.18 | No | 0 |

| 21.00 | No | 0 |

| 71.41 | No | 0 |

| 15.12 | No | 0 |

| 71.06 | Yes | 1 |

11.5.3 Reporting the results

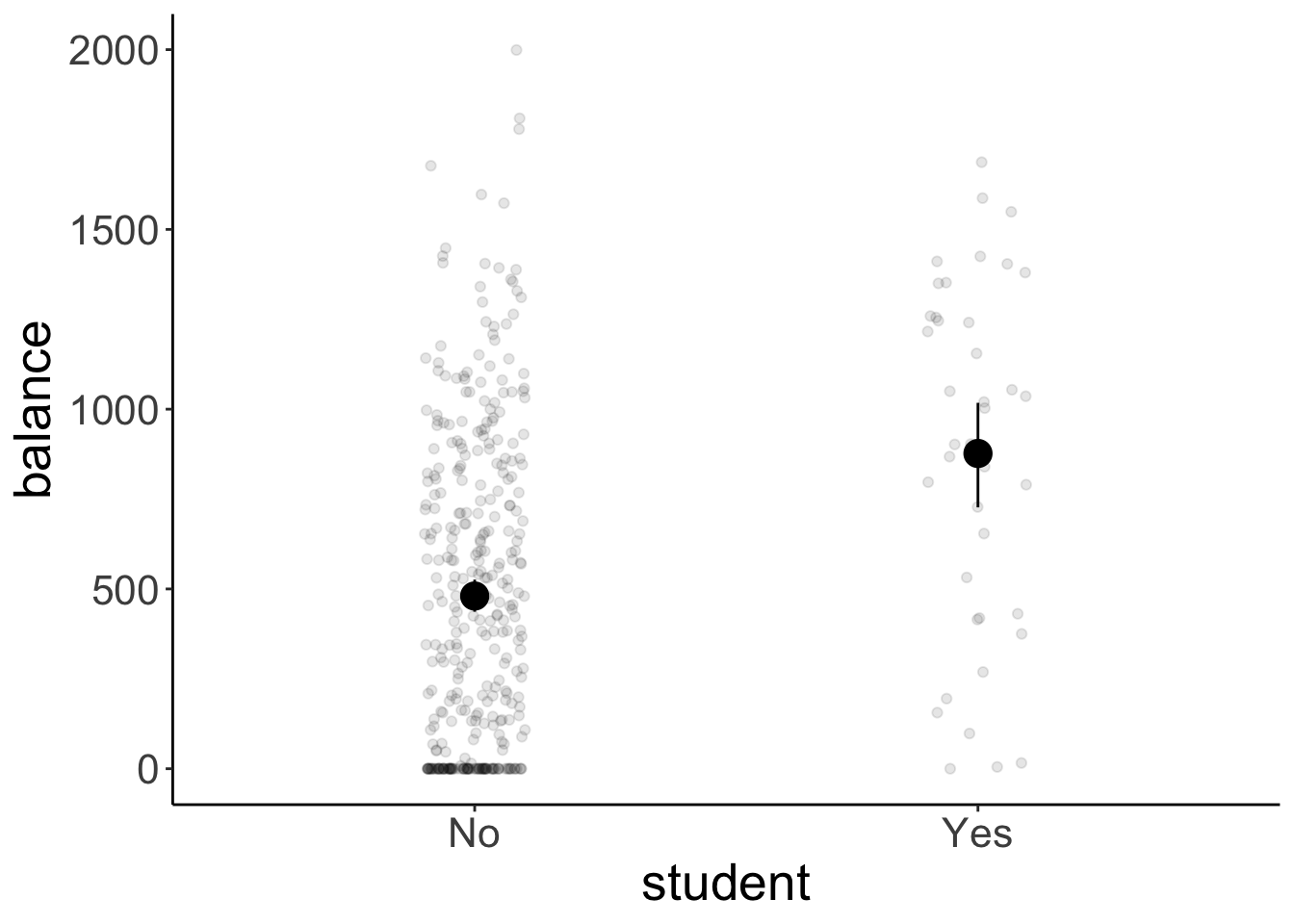

To report the results, we could show a plot like this:

df.plot = df.credit

ggplot(df.plot,

aes(x = student,

y = balance)) +

geom_point(alpha = 0.1,

position = position_jitter(height = 0, width = 0.1)) +

stat_summary(fun.data = "mean_cl_boot",

size = 1)

And then report the means and standard deviations together with the result of our signifance test:

df.credit %>%

group_by(student) %>%

summarize(mean = mean(balance),

sd = sd(balance)) %>%

mutate(across(where(is.numeric), ~ round(., 2)))# A tibble: 2 × 3

student mean sd

<chr> <dbl> <dbl>

1 No 480. 439.

2 Yes 877. 490 11.6 One continuous and one categorical variable

Now let’s take a look at a case where we have one continuous and one categorical predictor variable. Let’s first formulate and fit our models:

# fit the models

fit_c = lm(balance ~ 1 + income, df.credit)

fit_a = lm(balance ~ 1 + income + student, df.credit)

# run the F test

anova(fit_c, fit_a)Analysis of Variance Table

Model 1: balance ~ 1 + income

Model 2: balance ~ 1 + income + student

Res.Df RSS Df Sum of Sq F Pr(>F)

1 398 66208745

2 397 60939054 1 5269691 34.33 9.776e-09 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1We see again that it’s worth it. The augmented model explains significantly more variance than the compact model.

11.6.1 Visualization of the model predictions

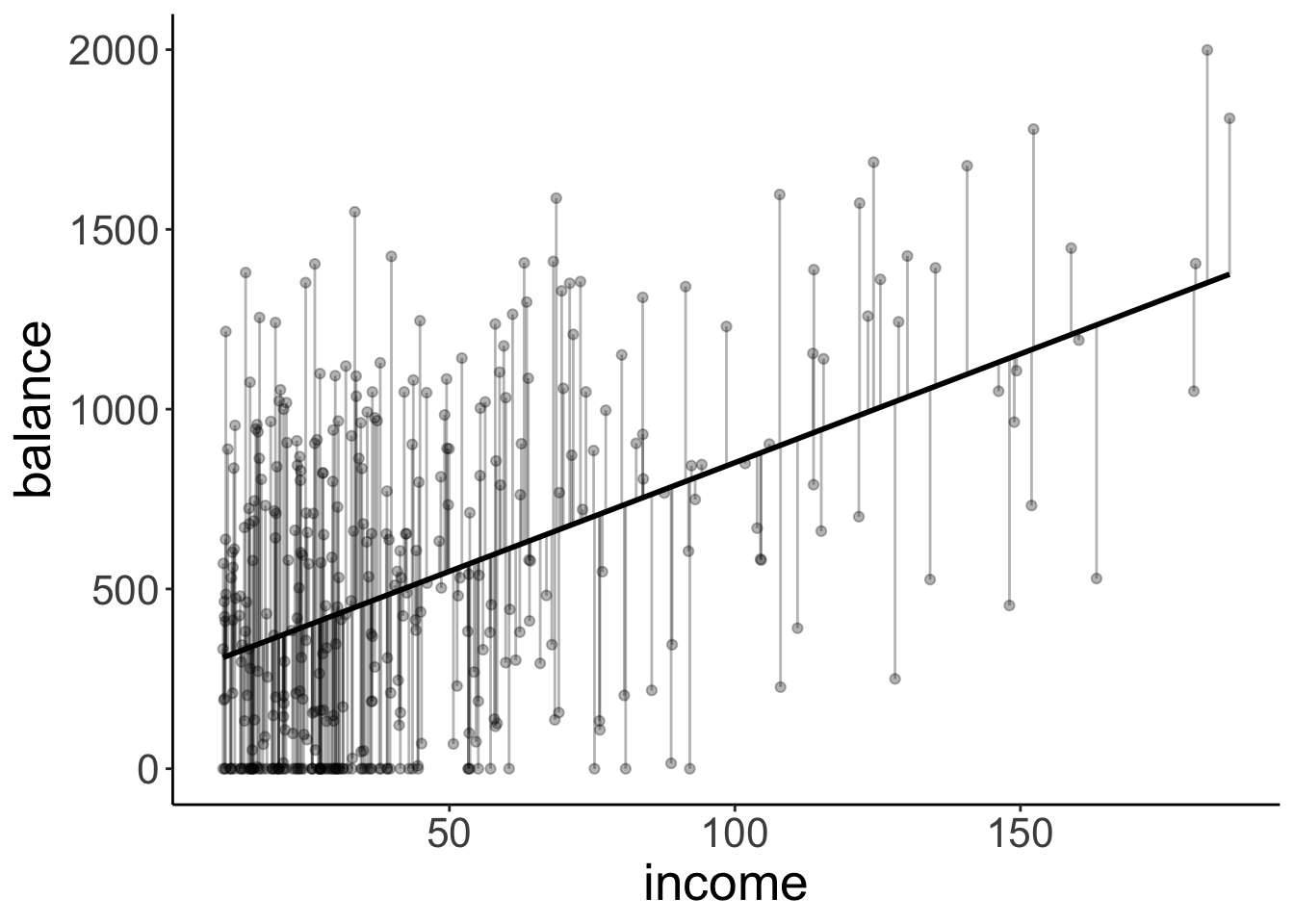

Let’s visualize the model predictions again. Let’s start with the compact model:

df.augment = fit_c %>%

augment() %>%

clean_names()

ggplot(df.augment,

aes(x = income,

y = balance)) +

geom_smooth(method = "lm", se = F, color = "black") +

geom_segment(aes(xend = income,

yend = fitted),

alpha = 0.3) +

geom_point(alpha = 0.3)`geom_smooth()` using formula = 'y ~ x'

This time, the compact model still predicts just one line (like above) but note that this line is not horizontal anymore.

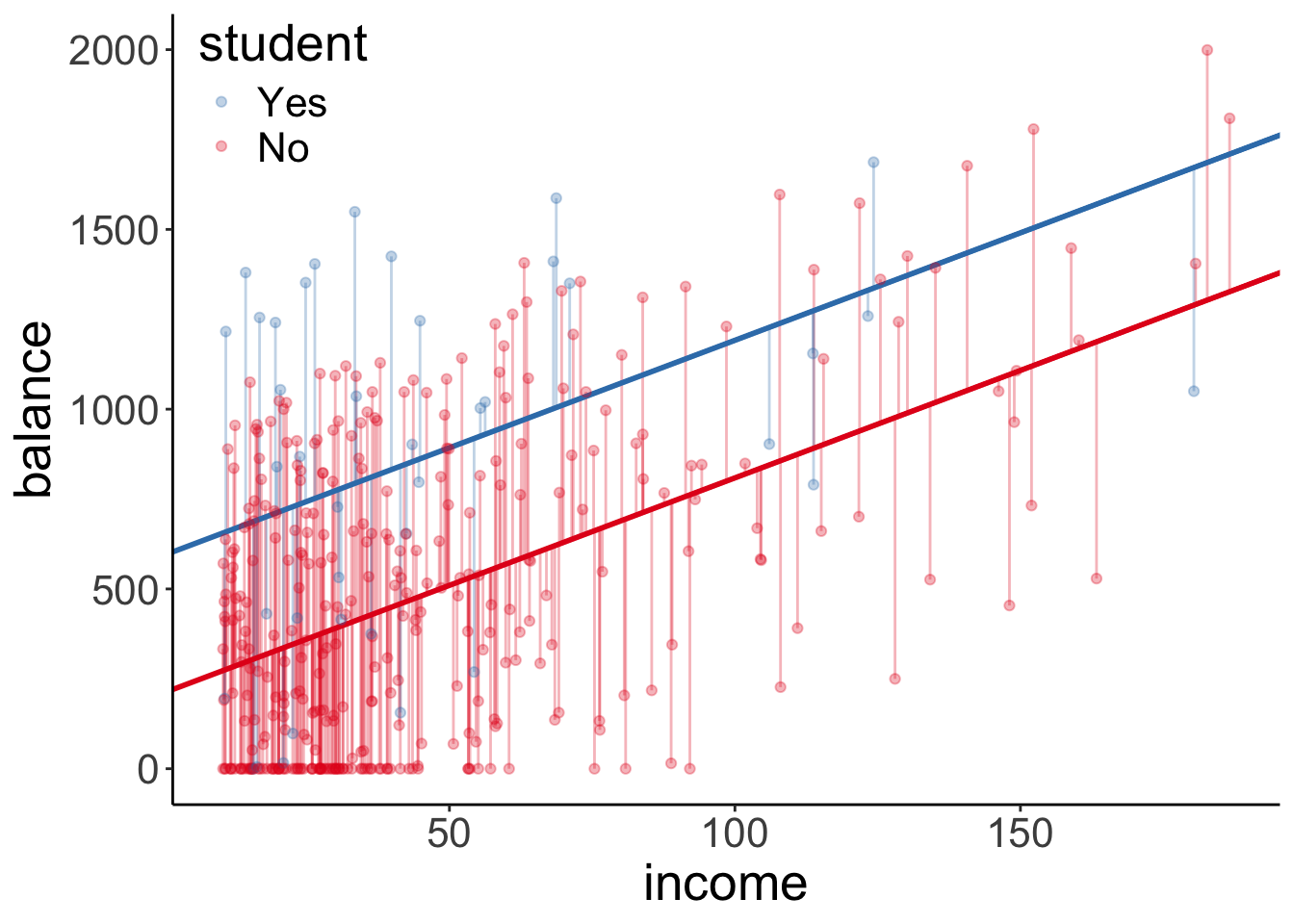

df.tidy = fit_a %>%

tidy() %>%

mutate(estimate = round(estimate,2))

df.augment = fit_a %>%

augment() %>%

clean_names()

ggplot(df.augment,

aes(x = income,

y = balance,

group = student,

color = student)) +

geom_segment(data = df.augment %>%

filter(student == "No"),

aes(xend = income,

yend = fitted),

color = "#E41A1C",

alpha = 0.3) +

geom_segment(data = df.augment %>%

filter(student == "Yes"),

aes(xend = income,

yend = fitted),

color = "#377EB8",

alpha = 0.3) +

geom_abline(intercept = df.tidy$estimate[1],

slope = df.tidy$estimate[2],

color = "#E41A1C",

size = 1) +

geom_abline(intercept = df.tidy$estimate[1] + df.tidy$estimate[3],

slope = df.tidy$estimate[2],

color = "#377EB8",

size = 1) +

geom_point(alpha = 0.3) +

scale_color_brewer(palette = "Set1") +

theme(legend.position = c(0.1, 0.9)) +

guides(color = guide_legend(reverse = T))

The augmented model predicts two lines again, each with the same slope (but the intercept differs).

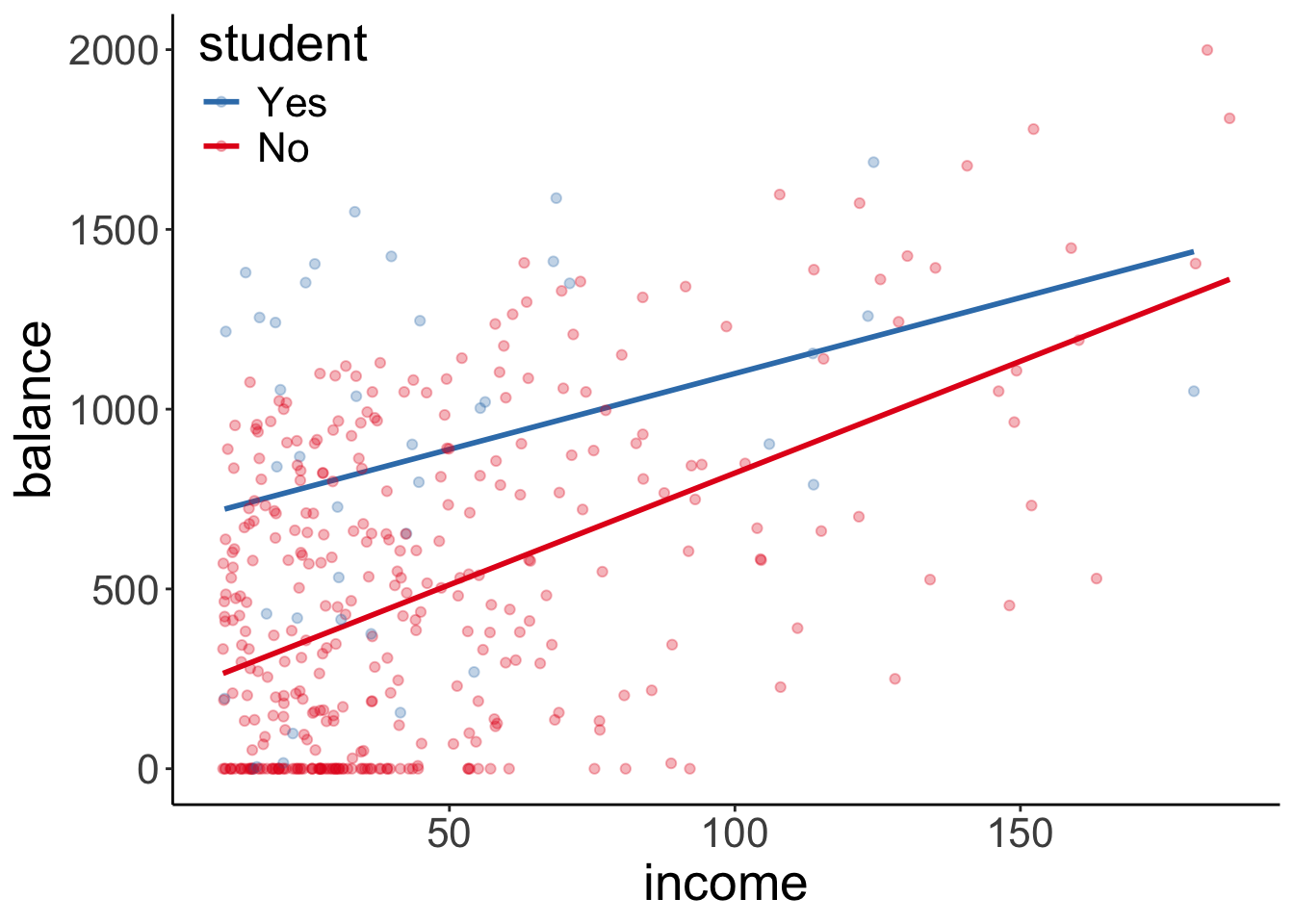

11.7 Interactions

Let’s check whether there is an interaction between how income affects balance for students vs. non-students.

11.7.1 Visualization

Let’s take a look at the data first.

ggplot(data = df.credit,

mapping = aes(x = income,

y = balance,

group = student,

color = student)) +

geom_smooth(method = "lm", se = F) +

geom_point(alpha = 0.3) +

scale_color_brewer(palette = "Set1") +

theme(legend.position = c(0.1, 0.9)) +

guides(color = guide_legend(reverse = T))`geom_smooth()` using formula = 'y ~ x'

Note that we just specified here that we want to have a linear model (via geom_smooth(method = "lm")). By default, ggplot2 assumes that we want a model that includes interactions. We can see this by the fact that two fitted lines are not parallel.

But is the interaction in the model worth it? That is, does a model that includes an interaction explain significantly more variance in the data, than a model that does not have an interaction.

11.7.2 Hypothesis test

Let’s check:

# fit models

fit_c = lm(formula = balance ~ income + student, data = df.credit)

fit_a = lm(formula = balance ~ income * student, data = df.credit)

# F-test

anova(fit_c, fit_a)Analysis of Variance Table

Model 1: balance ~ income + student

Model 2: balance ~ income * student

Res.Df RSS Df Sum of Sq F Pr(>F)

1 397 60939054

2 396 60734545 1 204509 1.3334 0.2489Nope, not worth it! The F-test comes out non-significant.

11.9 Session info

Information about this R session including which version of R was used, and what packages were loaded.

R version 4.4.2 (2024-10-31)

Platform: aarch64-apple-darwin20

Running under: macOS Sequoia 15.2

Matrix products: default

BLAS: /Library/Frameworks/R.framework/Versions/4.4-arm64/Resources/lib/libRblas.0.dylib

LAPACK: /Library/Frameworks/R.framework/Versions/4.4-arm64/Resources/lib/libRlapack.dylib; LAPACK version 3.12.0

locale:

[1] en_US.UTF-8/en_US.UTF-8/en_US.UTF-8/C/en_US.UTF-8/en_US.UTF-8

time zone: America/Los_Angeles

tzcode source: internal

attached base packages:

[1] stats graphics grDevices utils datasets methods base

other attached packages:

[1] lubridate_1.9.3 forcats_1.0.0 stringr_1.5.1 dplyr_1.1.4

[5] purrr_1.0.2 readr_2.1.5 tidyr_1.3.1 tibble_3.2.1

[9] tidyverse_2.0.0 GGally_2.2.1 ggplot2_3.5.1 corrplot_0.95

[13] corrr_0.4.4 broom_1.0.7 janitor_2.2.1 kableExtra_1.4.0

[17] knitr_1.49

loaded via a namespace (and not attached):

[1] tidyselect_1.2.1 viridisLite_0.4.2 farver_2.1.2 fastmap_1.2.0

[5] TSP_1.2-4 rpart_4.1.23 digest_0.6.36 timechange_0.3.0

[9] lifecycle_1.0.4 cluster_2.1.6 magrittr_2.0.3 compiler_4.4.2

[13] rlang_1.1.4 Hmisc_5.2-1 sass_0.4.9 tools_4.4.2

[17] utf8_1.2.4 yaml_2.3.10 data.table_1.15.4 htmlwidgets_1.6.4

[21] labeling_0.4.3 bit_4.0.5 plyr_1.8.9 xml2_1.3.6

[25] RColorBrewer_1.1-3 registry_0.5-1 ca_0.71.1 foreign_0.8-87

[29] withr_3.0.2 nnet_7.3-19 grid_4.4.2 fansi_1.0.6

[33] colorspace_2.1-0 scales_1.3.0 iterators_1.0.14 cli_3.6.3

[37] rmarkdown_2.29 crayon_1.5.3 generics_0.1.3 rstudioapi_0.16.0

[41] tzdb_0.4.0 cachem_1.1.0 splines_4.4.2 parallel_4.4.2

[45] base64enc_0.1-3 vctrs_0.6.5 Matrix_1.7-1 jsonlite_1.8.8

[49] bookdown_0.42 seriation_1.5.5 hms_1.1.3 bit64_4.0.5

[53] htmlTable_2.4.2 Formula_1.2-5 systemfonts_1.1.0 foreach_1.5.2

[57] jquerylib_0.1.4 glue_1.8.0 ggstats_0.6.0 codetools_0.2-20

[61] stringi_1.8.4 gtable_0.3.5 munsell_0.5.1 pillar_1.9.0

[65] htmltools_0.5.8.1 R6_2.5.1 vroom_1.6.5 evaluate_0.24.0

[69] lattice_0.22-6 backports_1.5.0 snakecase_0.11.1 bslib_0.7.0

[73] Rcpp_1.0.13 checkmate_2.3.1 gridExtra_2.3 svglite_2.1.3

[77] nlme_3.1-166 mgcv_1.9-1 xfun_0.49 pkgconfig_2.0.3